Car Loan Interest Rate Calculation Formula

A the monthly payment. I is the interest cost.

N Total of Months for the loan Years on the loan x 12 Example.

. To find the interest rate on the car loan you plan on applying for check out the loan agreement. Simple Interest 5000 65 5. Loan amount 50000.

Your interest rate multiplied by the outstanding principal amount is the interest. Divided over a period of 84 months that comes down to. To determine how much in interest you can expect to pay use the following amortization calculation formula.

In this step we must add the Amount Financed E1 - this may seem counterintuitive but because Excel correctly treats our calculated Payment as a cash outflow and assigns it a negative value we must add back the Amount. Then add the cost of interest to the principal amount of the loan. Thats the total interest you will pay over the life of your loan.

The simple interest formula for calculating total interest paid on the loan is. If rate of interest is 105 per annum then r 10512100000875. If you take out a 200000 mortgage at 4 interest over a 30-year term the calculation looks something like this.

A P x r1rn1rn - 1 In this formula the following signifies certain factors. With the Car EMI Calculator you only need to input the necessary information whether you intend to buy a new car or a pre-owned car the sanction loan amount required tenure of the loan interest rate and select calculate. Loan period 5 years.

The Auto Loan EMI Calculator offers you a detailed view of your yearly principal and interest repayment amounts. R Monthly Interest Rate in Decimal Form Yearly Interest Rate100 12. 200000 x 004 8000.

Following are the steps to calculate Simple Interest. Multiply it by the balance of your loan which for the first payment will be your whole principal amount. For car loans the interest rate is commonly referred to as the Annual Percentage Rate or APR.

P Principal Amount on the Loan. The equation to calculate principal P interest rate r and number of monthly payments m. C Monthly Payment.

Car loan interest charges - It is already evident by now that the interest rate on car loan is one of the prime factors of the EMI. Multiply the result by the balance of your loan. Monthly payment for 5 year auto loan with a principal.

Principal loan amount x Interest rate x Time aka Number of years in term Interest. However once you calculate the total interest rate. Check our financing tips and find cars for sale that fit your budget.

Example Loan Payment Calculation. Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval. In this case the effective interest rate EIR for this car loan is 627.

Principal x interest rate x number of years total interest due on loan. Suppose you take a 20000 loan for 5 years at 5 annual interest rate. Heres the formula to calculate EMI.

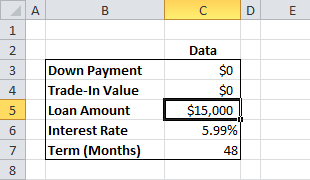

In the simplest words EIR is the true rate of interest earned factoring in compounding effect. Divide the interest rate for your loan by the number of monthly payments youll make this year. Payment P r 12 1 - 1 r 12 -m For example a 3 year 36 month loan of 15000 at 7 interest would look like this.

Ie r Rate of Annual interest12100. This is how to calculate the effective interest rate on a car loan. Monthly interest interest rate 1 2 loan balance textMonthly interestbiggfractextinterest rate12biggtimestextloan balance Monthly interest 1 2 interest rate.

If you want to break that down by monthly payment cost you can divide the final number by the months it will take to pay off the loan. P is Principal Loan Amount. Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Worry Free.

With each successive payment youll pay more towards the principal and less in interest. Interest rate 25. R is rate of interest calculated on monthly basis.

Payment 15000 007 12 1 - 1 007 12 -36. I RN A. You can calculate your interest costs using the formula I P x R x T where.

For the first payment this will be your entire principal amount. The interest rate looks moderate as a percentage for most of the schemes. When figuring out how to calculate auto loan interest for the initial payment the steps below can help.

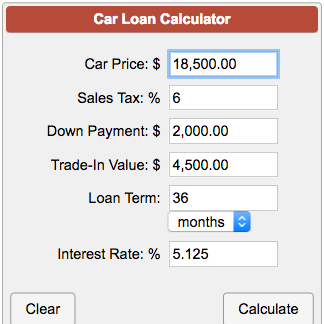

Your monthly instalment loan amount total interest loan period x 12 For example you have a car loan amount of RM50000 and a loan period of five years to be paid at a flat interest rate of 25. How to Calculate Auto Loan Interest. To calculate the monthly payment on an auto loan use this car payment formula.

Divide your interest rate by the number of monthly payments you will be making over the course of the year. Firstly determine the outstanding loan amount extended to the borrower and it is denoted by P. Simple Interest 1625 Therefore the 2 nd option is the cheaper one despite higher interest rates because the 1 st option is more expensive due to annual compounding.

I Interest R Rate of Interest N Number of repayments A Principle amount credited. N 5 12 60 months i 5 100 12 0004167 interest rate per month. Hence below youll be taught how to calculate the effective interest rates on a loan.

Add up the total interest paid over the life of the loan in cell E5 by entering the following formula without quotation marks. Email Us or Call Us. You can calculate your total interest by using this formula.

RM1039920084 RM1238 per month.

Auto Loan Calculator Calculate Car Loan Payments

Create A Basic Car Loan Calculator In Excel Using The Pmt Function

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

No comments for "Car Loan Interest Rate Calculation Formula"

Post a Comment